What are financial statements and why should I care?

No matter how big or small your business is, whether you do your own bookkeeping or you have an entire accounting team, there are three financial reports that all entrepreneurs must know like the back of their hands: Balance Sheet. Profit & Loss (or Income) Statement. Cash Flow Statement

Technically:

Financial statements are written records that convey the business activities and the financial performance of a company.

Why should I care:

The objective of financial reporting is to track, analyse and report your business income. The purpose of these reports is to examine resource usage, cash flow, business performance and the financial health of the business. This helps you make informed decisions about how to manage the business.

Why are financial statements important:

Financial statements provide a snapshot of a corporation’s financial health, giving insight into its performance, operations, and cash flow. Financial statements are essential since they provide information about a company’s revenue, expenses, profitability, and debt.

Now that we got that boring technical stuff out of the way.

The financial package is made up of three reports.

- Income Statement aka Profit and Loss

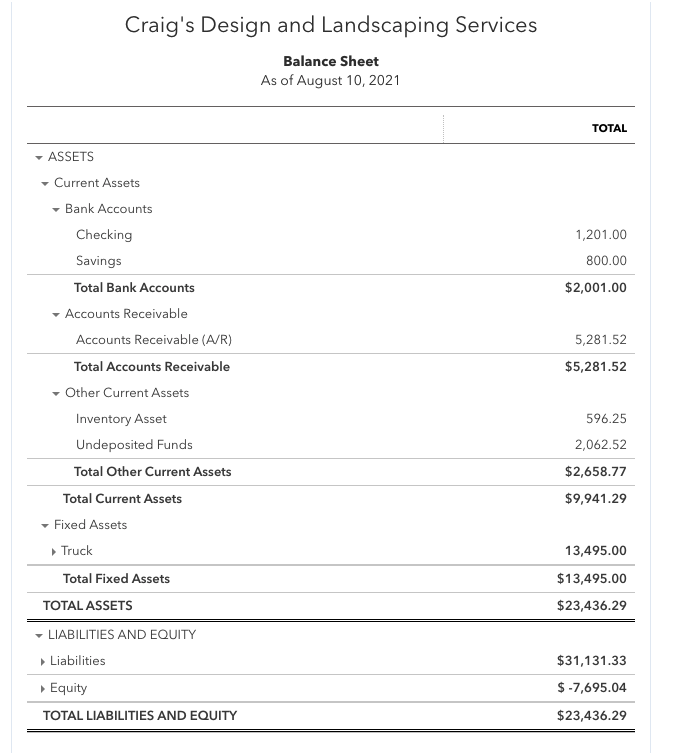

- Balance Sheet

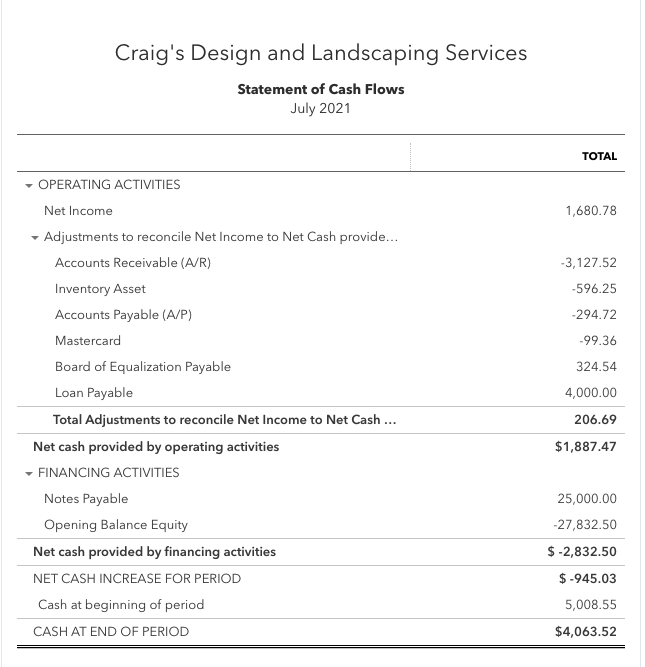

- Statement of Cash Flows

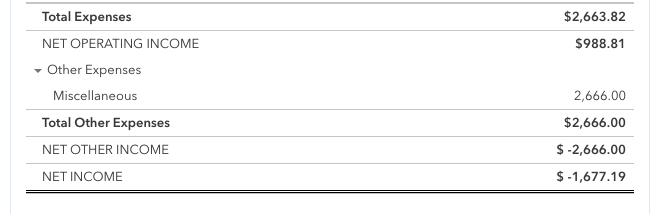

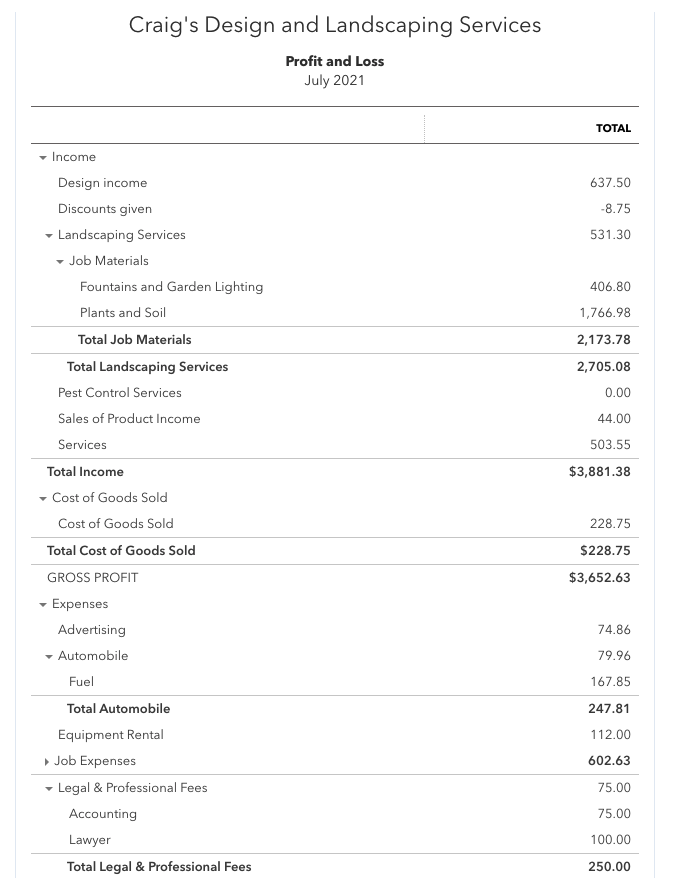

An income statement aka profit & loss, sums up a company’s revenues, expenses and costs incurred over a specific period.

The profit and loss statement shows a snapshot of the companies revenue and expenses during a specific period of time. The profit and loss statement is the one report that most business owners know about and it gets the most attention. The goal as a business is to create a profit for the business owner.

The top line of the P&L statement shows the company’s total revenues from all income streams.

Next is the Cost of Goods Sold section.

Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good.

Gross profits are used to cover overhead expenses and, hopefully, leave a net profit.

Typical overhead expenses are as follows:

- Salaries/Wages

- Advertising

- Insurance

- Permits and licenses

- Office rent

- Telephone

- Supplies

- Legal fees

- Accounting fees

- Travel costs

At the bottom of the report you will see the net income. This is the Revenue minus your cost of goods sold and expenses for that time period.