Managing cash flow can be a daunting task for any business owner. It’s easy to get caught up in the day-to-day operations and neglect the financial health of your company. That’s why the book Profit First by Mike Michalowicz has become a game-changer for small businesses. In this blog post, we’ll dive into the key concepts of Profit First and how implementing its cash flow system, specifically the Profit First Percentages, can help you take control of your finances and drive success for your business. So, let’s get started!

Understanding the Basics of Profit First System

Managing your business’s cash flow can be overwhelming, but Profit First offers a revolutionary system to simplify and optimize your financial health. By implementing Profit First, you prioritize profit and allocate funds accordingly. This system shifts the traditional formula of Sales – Expenses = Profit to Sales – Profit = Expenses.

In other words, profit is taken first and expenses are adjusted accordingly. By understanding this fundamental concept, you can start reaping the benefits of Profit First and take control of your cash flow.

The Core Tenets of Profit First Methodology

The core tenets of Profit First methodology revolve around four key principles.

First, you must prioritize profit by taking it first from your revenue and allocating it accordingly.

Second, you need to implement multiple bank accounts to manage and separate different financial purposes.

Third, you should establish a rhythm for regularly allocating funds to different accounts based on predetermined percentages.

Lastly, you must make adjustments to your business expenses to ensure they align with your profit goals. By adhering to these tenets, you can transform your cash flow and achieve greater financial success for your business.

Detailed Walkthrough on Implementing Profit First in Your Business

Now that you have a basic understanding of Profit First, it’s time to dive into the detailed walkthrough on implementing this cash flow system in your own business.

The first step is to set up separate bank accounts for different financial purposes, such as profit, taxes, operating expenses, and owner’s compensation.

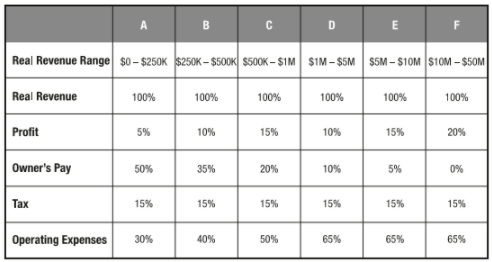

Next, determine the percentages of your revenue that will be allocated to each account. This ensures that profit is prioritized and set aside first.

Finally, establish a rhythm for regularly allocating funds to each account based on these percentages. This step-by-step approach will help you effectively implement Profit First and take control of your cash flow.

Structuring Your Cash Flow With Profit First Percentages

Once you’ve set up separate bank accounts for profit, taxes, operating expenses, and owner’s compensation, it’s time to structure your cash flow with Profit First percentages. These percentages determine how much of your revenue will be allocated to each account. By following these predetermined percentages, you ensure that profit is always prioritized and set aside first. This systematic approach allows you to effectively manage your cash flow and achieve financial success for your business. It’s a simple yet powerful strategy that puts you in control of your finances and helps you make informed decisions for your business’s growth.

Overcoming Challenges in Applying the Profit First Approach

Implementing the Profit First approach may come with its fair share of challenges. One common challenge is breaking the habit of using all your revenue for expenses. It can be difficult to prioritize profit when you’re used to putting it on the back burner. Another challenge is sticking to the predetermined percentages and consistently allocating funds to different accounts. It requires discipline and a commitment to following the system. Lastly, adjusting your expenses to align with your profit goals can be a challenge, especially if you’re used to spending freely. However, by recognizing and overcoming these challenges, you can successfully implement Profit First and reap the rewards for your business’s financial success.

Need some help getting started? Click below and let’s set up a call!

Leave a Reply