In a world where financial decisions can shape the course of our lives, the pursuit of financial freedom is a universal aspiration. Amidst the complexities of managing money, the guidance of a skilled financial coach becomes a beacon, illuminating the path toward true financial independence. In this post, we delve into the profound impact a financial coach can have on unlocking the doors to financial freedom.

Understanding Financial Freedom

Financial freedom is not merely about accumulating wealth; it’s a state where your money works for you, allowing you to live life on your terms. It’s about making informed choices, having a clear financial vision, and feeling empowered to achieve your goals without the weight of financial stress.

The Role of a Financial Coach in Your Journey

**1. Personalized Financial Roadmap:

A financial coach acts as your guide, helping you navigate the intricacies of your unique financial landscape. They work with you to create a personalized roadmap, aligning your financial goals with actionable steps.

**2. Building Financial Literacy:

Understanding the language of finance is essential. A financial coach not only advises but also educates, ensuring you comprehend the principles behind financial decisions. This knowledge becomes the bedrock of your financial empowerment.

**3. Goal Setting and Prioritization:

Financial freedom is often the result of intentional goal-setting. Your coach collaborates with you to define short-term and long-term goals, guiding you in prioritizing and strategizing to achieve them.

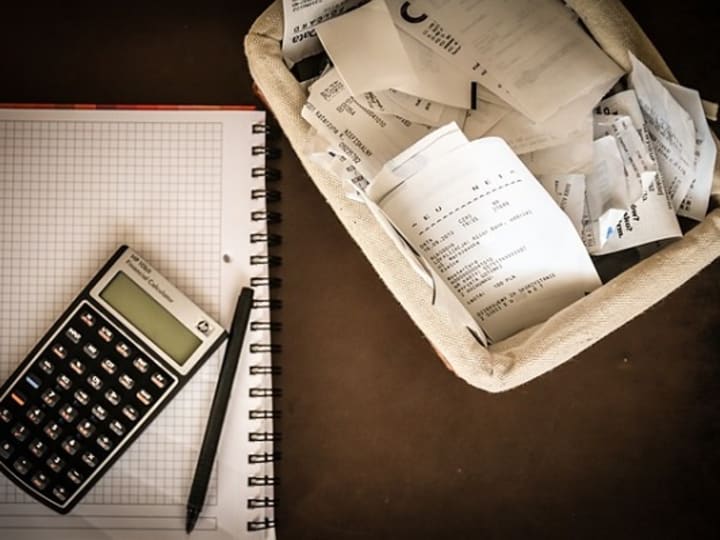

**4. Budgeting for Success:

Budgeting is not about restriction; it’s about mindful allocation of resources. Your financial coach helps you create a realistic budget that aligns with your lifestyle and aspirations, fostering disciplined financial habits.

**5. Debt Management Strategies:

Debt can be a roadblock to financial freedom. Your coach assists in developing strategies to manage and eliminate debt effectively, freeing up resources for wealth-building endeavors.

**6. Investment Guidance:

Making informed investment decisions is crucial for wealth accumulation. Your financial coach provides insights into investment options, risk management, and building a diversified portfolio tailored to your goals. Referring you to a investment professional to finish the process.

**7. Emergency Fund and Risk Mitigation:

Financial peace of mind comes from being prepared for the unexpected. A financial coach emphasizes the importance of an emergency fund and helps you implement risk mitigation strategies to safeguard your financial future.

**8. Accountability and Motivation:

Embarking on a journey to financial freedom requires discipline. Your coach serves as an accountability partner, providing motivation and support to stay on track, especially during challenging times.

Empowering Your Financial Journey

In the pursuit of financial freedom, a financial coach is not just an advisor; they are a collaborator, an educator, and a motivator. Together, you work towards unlocking the full potential of your finances, breaking free from the constraints that hinder your path to financial independence.

Remember, financial freedom is not a destination; it’s a journey. With a dedicated financial coach by your side, you gain the tools and knowledge needed to navigate this journey with confidence, transforming your financial aspirations into a reality. Embrace the partnership, unlock the doors, and step into a future where financial freedom is not just a dream but a tangible and achievable reality.

Leave a Reply